Closing Costs in Mexico

Congratulations! You are this close to owning a home in Mexico. Your offer has been accepted, and you’ve probably enlisted the services of a local real estate agent and lawyer to help with the purchase process. The only thing left is the closing, where all this becomes official, and your dream becomes a reality.

Closing on a home in Mexico is exciting, but it’s also a process that involves serious attention to detail. We’re here to fully explain that process so you can focus on purchasing your Mexican home.

*All prices listed below are in USD unless otherwise noted.

Learn about Buying in Mexico

Or call us at 1-888-808-0274

By pressing Contact us you agree to Far Homes’

Terms of Service and Privacy Policy.

How much can I expect to pay in total closing costs for a property in Mexico?

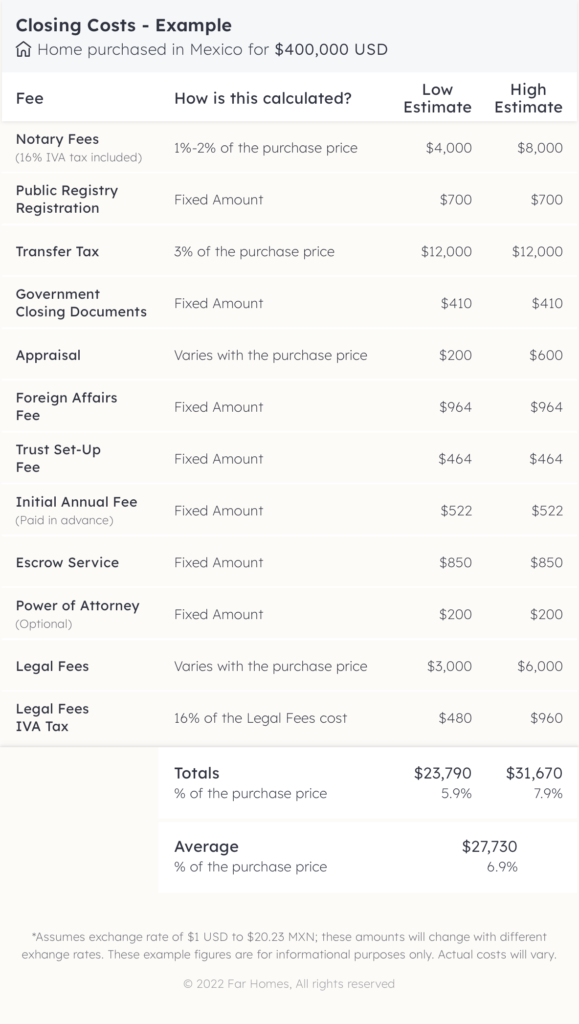

The property transfer process is where the Mexican government gains a relatively high percentage of its revenue. It’s a heavily regulated activity that involves a number of fees and stipulations. Experts offer many suggestions on what the total cost will be, but it’s important to remember that the ultimate number largely depends on your particular property and location. With that in mind, closing costs in Mexico usually range from 5%-10% of a home’s sale price. It’s not unheard of for the total to be lower (or higher), but considering the number of fees built into the transfer of ownership, keeping closing costs below this number is unlikely.

That being said, there are factors and policies that often offset the financial burden of these fees. First, residential real estate is relatively inexpensive in Mexico. A property in Mexico usually costs substantially less than a comparable one in the United States. The Mexican government also requires that buyers pay a large chunk of their property taxes at closing. This means that later property tax payments are usually much lower than expected, and make the closing costs a little more acceptable.

Who Pays Closing Costs in Mexico?

The parties responsible for paying closing costs are outlined in the real estate purchase agreement. Much like in the U.S, the buyer is usually responsible for all or nearly all closing costs. Hiring a lawyer to guide you through the process is a smart option. After all, these fees can get complicated, and sometimes require you to file specific paperwork with government agencies. To get a sense of what the fees are and what costs they might incur here’s a rundown of the costs associated with closing on a property in Mexico:

The Notary Public

Notary Publics or Notarios Públicos are essentially the emcees of the real estate transfer process. These highly-trained attorneys are government representatives assigned to supervise the property transfer. They usually command a fee of around 1%-2% of the Valor Catastral, the tax appraisal of the property. Their fee also includes a 16% country-wide sales tax for goods and services known as the IVA. While the IVA tax does not apply to residential property sales, it will be part of the fees for whatever services you employ throughout the purchase process. It’s also worth noting that the Notario is meant only to oversee the real estate transaction, and does not work on your behalf.

The Transfer Tax

One of the largest fees a buyer can expect to pay is the transfer tax–also known as the acquisition tax. This can run anywhere from 2-5% of the selling price, depending on the state in which you’re buying. For instance, the transfer tax rate in Playa Del Carmen is 3%, while real estate purchases in Los Cabos command just a 2% transfer tax.

The Fideicomiso

If you’re familiar with Mexico, it’s likely you’ve encountered the fideicomiso. This is a trust held by a Mexican bank that allows foreign buyers to enjoy all the benefits of property ownership without owning their property outright. Technically all the land within 50km of the Mexican coast and 100km of the country’s borders is a “Restricted Zone”, where only Mexican citizens can own property. However, expats can essentially own the land through a trust–a fideicomiso–made through a Mexican bank. While the bank holds the legal title to the property, the property is not the bank’s asset. Instead, the buyer is designated as the legal beneficiary of the trust and instructs the bank on all legal actions related to the property.

Basically, it’s a simple mechanism that satisfies the laws of the Mexican Constitution while allowing foreign buyers to fully gain the rights as owners of residential property. However, setting up and maintaining this trust requires some investment. The rates for establishing a fideicomiso vary between banks. It’s not unheard of to pay a trust set-up fee that can cost $1600-$1800 to establish and then $450-$600 per year each year after. The first annual maintenance fee is also due at closing, which usually costs from $500-$600. Once this trust is set up and maintained, however, beneficiaries have all the benefits of property ownership, and can renew the agreement every 50 years.

The Property Appraisal in Mexico

The official residential real estate appraisal known as a tax or catastral appraisal is required for the notary’s preparation of transfer, to establish tax liability, and to assess the annual property tax payment (predial). It’s carried out by a government-appointed official, usually an architect, called the Perito Valuador. This requires no on-site inspection, and is performed using tables based on characteristics like square-meters of construction and the home’s age. This varies with the home’s purchase price, but usually costs between $100-$500. Fortunately, the appraisal usually comes in well below the selling price, which means pleasantly low property taxes.

The Foreign Affairs Fee (SRE Permit)

Foreign buyers must go through the Ministry of Foreign Affairs to obtain an SRE permit to own property in Mexico. This establishes that the buyer will relate to the Mexican government as a citizen in matters of real estate. It essentially ensures that the buyer won’t involve foreign governments and that they will submit to the processes and rulings of Mexican courts. In return, the buyer gets to enjoy all the benefits of property ownership associated with being a legitimate Mexican national. It’s an important relationship to officially establish, and the cost to obtain this permit is usually between $900 and $1200.

Property Registration Fee

The fee for registering your property in the Land Registry Office (LRO) varies based on the state in which you’re buying, but it is normally around .05-1.5% of the final sale price.

Governmental Closing Documents

With the help and direction of the notary, the government requires a number of documents that must be processed in order for the property sale and transfer to be complete. Documents like the proof of down payment, a copy of the associated deeds, and a copy of the architectural plans require attention from various entities within the government. Costs related to the assessment and processing of these documents can climb to around $500.

Legal Fees

As you might have figured out from the explanations above, this entire process can be a little complex. That’s why it’s generally a good idea to engage a lawyer to guide you through the process of the real estate transaction. Attorneys provide a menagerie of crucial services, from performing a title search to working with various government agencies to ensure that you’re ready to move forward by the closing date. Engaging a lawyer in the process will ultimately save you a lot of time, headaches, and possibly money in the long run. However, they do command fees for their expertise and convenience. It’s not uncommon for lawyers to require up to $5000 (including the 16% IVA tax) from the beginning of the process until closing. After all, they do play an instrumental role in delivering you to your new doorstep in Mexico.

Optional Fees

Escrow

The use of escrow services is becoming more and more prevalent in Mexico. Both buyers and sellers are beginning to see the benefit of placing a significant amount of money (usually 5-10% of the purchase price) in the possession of a third party to protect themselves and help facilitate real estate transactions. Lawyers, banks, and real estate agents are often willing to operate as the third party and hold the money in a separate account. It’s always recommended, however, that you use a Canadian or US escrow service to ensure that your deposit is protected. Putting money in escrow is not necessarily common practice, but it is gaining a foothold in Mexico’s real estate process. Especially since, at usually less than $1000, the fee is justifiable when considering the protection, the practice affords to the parties involved in the transaction.

Power of Attorney

As a foreign buyer, there’s a real possibility that you might not actually be in Mexico for the complete process of your real estate transaction. So, it’s often wise to leave someone to represent you by granting them power of attorney. This can be done easily and relatively cheaply through your lawyer. Just consult with your original Mexico lawyer on the type of authorization you need to grant (it will likely be Power of Ownership, which involves acts related to real estate), and then have the POA prepared.

The power of attorney can be granted whether you are initially in the country but must leave during the transaction, or if you are making the purchase while abroad and are therefore unable to be present for any of the proceedings.

Learn about Buying in Mexico

Or call us at 1-888-808-0274

By pressing Contact us you agree to Far Homes’

Terms of Service and Privacy Policy.